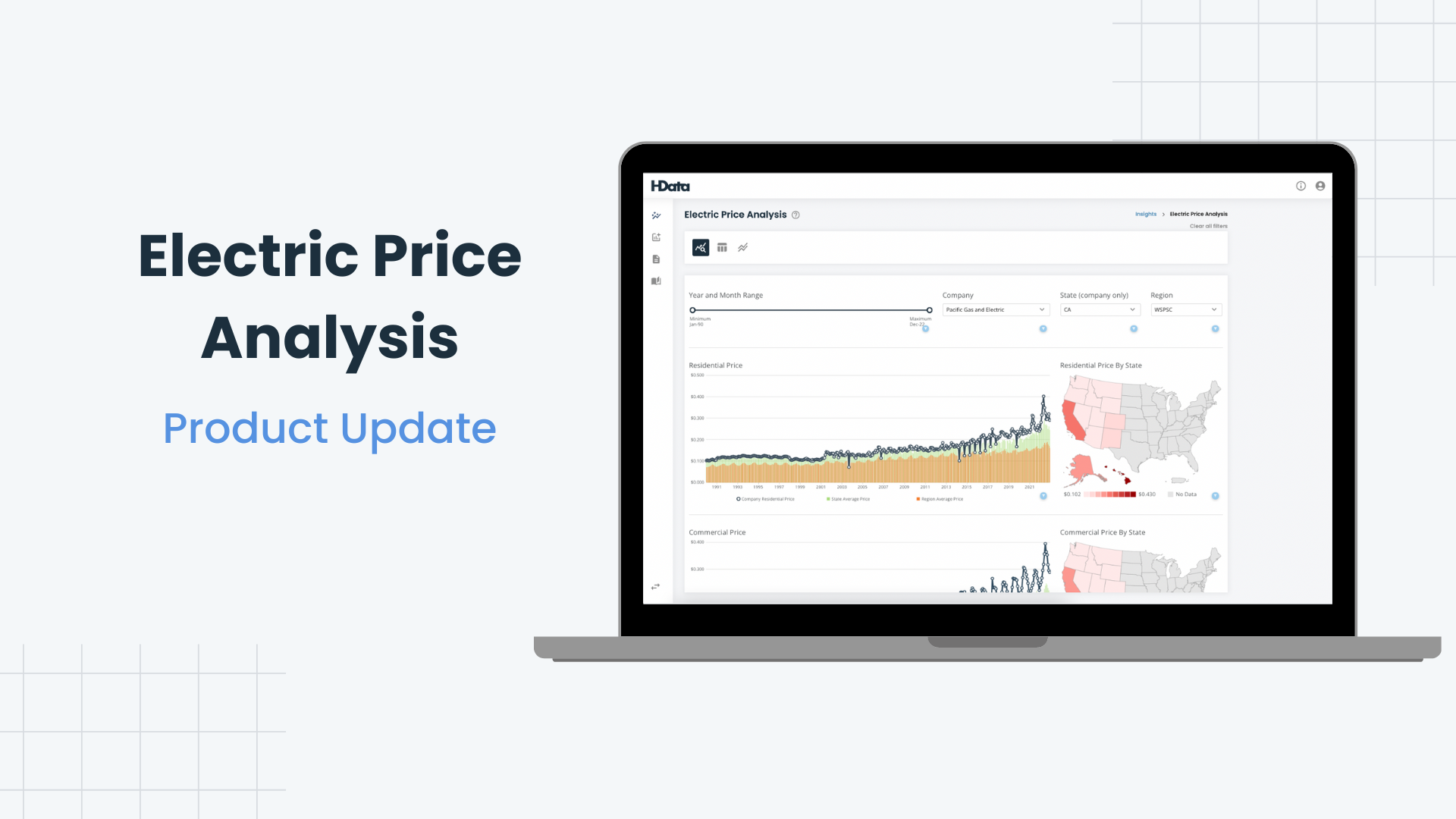

HData, a leading provider of regulatory data and analytics solutions, has published an analysis of the FERC Form 1 filings, which provides a comprehensive overview of the electric utility industry's financial and operating performance. The analysis highlights the importance of the form for investors, regulators, and other stakeholders in gaining a better understanding of the sector.

By evaluating factors such as operating revenues, expenses, and net income, the report sheds light on the industry's current state and future prospects.

The electric utility industry is pivotal in the modern world, powering our homes, businesses, and public services. Understanding the industry's financial and operational performance is crucial for investors, regulators, and stakeholders alike. The FERC Form 1 filings provide a comprehensive overview of this performance, highlighting the trends and factors shaping the sector.

In this blog post, we'll delve into HData's analysis of these filings and explore the key insights that can help drive informed decision-making and strategic planning in the electric utility industry.

Key Insights from the FERC Form 1 Data:

- Operating Revenues Increased almost 10%, but non-return O&M expenses greatly increased between 2021 and 2022 (18.4% total increase in fuel expenses)

- Amount of Purchased Power increased greatly (29%)

- Inflationary pressures, fuel spikes, and how the companies handled them are easily obvious in the data

- Collecting this information is much quicker than before (i.e. we got all this collected, visualized, and presented in roughly a few days work)

Financial Performance of the Electric Utility Industry: Operating Revenues, Expenses & Net Income Analysis

One of the most important metrics in assessing the financial performance of the electric utility industry is operating revenues, which represent the income generated by providing electricity services. On the other hand, operating expenses encompass the costs incurred in producing, transmitting, and distributing electricity. By examining the trends and contributing factors to these metrics, we can gain valuable insights into the industry's profitability.

Over the past few years, the electric utility industry has witnessed a steady increase in operating revenues, driven by population growth, increased demand for electricity, and higher electricity prices. At the same time, operating expenses have also risen at a greater rate than revenue, primarily due to higher fuel and maintenance costs and increased investment in infrastructure and technology. However, despite these rising costs, the industry has managed to maintain a relatively stable operating margin, thanks to improved efficiency and cost management.

"The FERC Form 1 filings are a goldmine of information for anyone looking to gain insights into the electric utility industry,” said Rogers Herndon, Managing Director at Alvarez & Marsal. “The comprehensive analysis provided by HData not only enables investors, regulators, and stakeholders better to understand the industry's financial and operational landscape but also serves as a valuable tool for decision-making and strategic planning."

Net income is another crucial aspect of the electric utility industry's financial performance, which represents the company's earnings after accounting for all expenses. An analysis of the FERC Form 1 filings reveals several factors that have affected net income in recent years, such as regulatory changes, shifts in energy markets, and fluctuations in commodity prices.

Many electric utilities have witnessed increased net income, driven by higher revenues and effective cost management strategies. This positive trend has significant implications for investors and stakeholders, reflecting the industry's ability to generate value and maintain financial stability amidst a constantly evolving landscape.

Key Operational Metrics from FERC Form 1 Filings

Beyond financial metrics, the FERC Form 1 filings also provide valuable insights into the operational performance of the electric utility industry. Two key areas to consider are plant investment and performance and transmission and distribution efficiency.

Plant investment and performance metrics, such as plant capacity, availability, and utilization rates, can clearly show how effectively the industry is managing its assets and meeting the demand for electricity. Recent trends indicate that many utilities have invested heavily in upgrading and expanding their generation facilities, resulting in improved performance and increased capacity.

"FERC Form 1 filings are a critical resource for understanding the electric utility industry's performance and trends. Our analysis of the HData platform highlights the key insights, enabling stakeholders to make informed decisions and gain a competitive edge in the market,” said HData’s Regulatory Economist, Luke Ashton. “To add to this, we conducted this entire analysis in a few days time. Because of what the FERC did with XBRL and what we at HData did by building our innovative business intelligence solutions on top of the FERC’s XBRL data, we greatly reduced the time it’d take many other analysts to do the exact same work."

Transmission and distribution efficiency, on the other hand, can be assessed by examining factors such as line losses, service reliability, and outage duration. The FERC Form 1 filings show that the industry has made significant strides in enhancing the efficiency of its transmission and distribution networks, thanks to the adoption of advanced technologies and grid modernization efforts.

Industry Trends and Their Implications for the Future

Looking ahead, several industry trends are likely to have a profound impact on the electric utility industry. Technological advancements, such as the increasing adoption of renewable energy sources, energy storage solutions, and smart grid technologies, are poised to transform the industry's operations and drive further efficiency gains.

Additionally, regulatory changes, such as the introduction of new environmental standards and the ongoing shift towards decarbonization, will require utilities to adapt and evolve their strategies to remain competitive and compliant.

In conclusion, the FERC Form 1 filings offer invaluable insights into the financial and operational performance of the electric utility industry. By analyzing these filings, stakeholders can better understand the trends and factors shaping the sector and make informed decisions for the future. As our analysis has shown, the industry has demonstrated resilience and adaptability in the face of rising costs and evolving market conditions, maintaining profitability and driving improvements in operational performance.

As technological advancements and regulatory changes continue redefining the landscape, electric utilities must stay agile and responsive to capitalize on new opportunities and address emerging challenges. The FERC Form 1 filings are vital for decision-making and strategic planning, helping stakeholders navigate this complex and dynamic industry.

Are you ready to unlock the full potential of FERC Form 1 filings and gain a competitive edge in the electric utility industry? Take advantage of the opportunity to explore key insights from our analysis and learn actionable strategies for success.

Request a demo now and gain access to an exclusive experience that will equip you with the knowledge and tools needed to make informed decisions and stay ahead of the curve in this dynamic industry.